Top PMS Solutions to Grow Your Wealth.

Top PMS Solutions to Grow Your Wealth.

Portfolio Management Services (PMS) are investment services offered by financial institutions to manage an individual’s or an entity’s investment portfolio. In PMS a professional portfolio manager makes investment decisions on behalf of the client tailored to their financial goals, risk tolerance and investment horizon. PMS typically caters to high-net-worth individuals or institutions offering personalized investment strategies, active monitoring and regular reporting. Clients benefit from professional expertise and customized investment solutions aiming to maximize returns while managing risks effectively.

Portfolio Management Services (PMS) are investment services offered by financial institutions to manage an individual’s or an entity’s investment portfolio. In PMS a professional portfolio manager makes investment decisions on behalf of the client tailored to their financial goals, risk tolerance and investment horizon. PMS typically caters to high-net-worth individuals or institutions offering personalized investment strategies, active monitoring and regular reporting. Clients benefit from professional expertise and customized investment solutions aiming to maximize returns while managing risks effectively.

Types of PMS

Discretionary PMS

Portfolio manager has full authority to make investment decisions without client approval offering convenience.

Non-Discretionary PMS

Clients retain final decision-making power receiving advice from the portfolio manager for greater control.

Model Portfolio PMS

Clients select from predefined investment models based on risk and objectives.

Customized PMS

Tailored investment solutions meeting individual client needs through close collaboration.

Benefits of PMS

Benefits of PMS

Customized Strategies

Investment plans are carefully designed to align with your unique financial objectives, risk tolerance and long-term goals ensuring that every decision works towards your personal success.

Expert Management

Your portfolio is managed by experienced professionals who bring a wealth of market knowledge and expertise ensuring that your investments are strategically placed for optimal growth.

Diversified Portfolio

By distributing investments across various asset classes and sectors PMS helps reduce risk while aiming for better overall returns, making your portfolio more resilient to market fluctuations.

Active Monitoring

With continuous oversight and proactive management your portfolio is regularly reviewed and adjusted to keep it on track, capitalizing on market opportunities and minimizing potential risks.

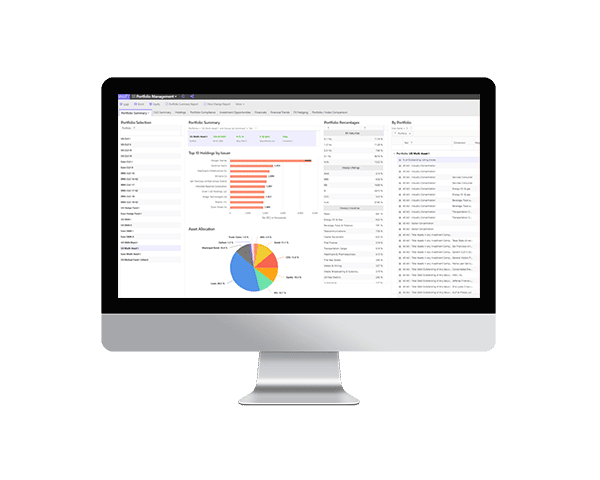

Transparent Reporting

Stay informed with detailed easy-to-understand reports that offer a clear view of your portfolio’s performance, updates and any strategic changes made providing full transparency.

Wealth Creation

Designed for high-net-worth individuals, PMS focuses on building wealth over time with strategies that focus on sustained growth and maximizing returns for the future.

Customized Strategies

Investment plans are carefully designed to align with your unique financial objectives, risk tolerance and long-term goals ensuring that every decision works towards your personal success.

Expert Management

Your portfolio is managed by experienced professionals who bring a wealth of market knowledge and expertise ensuring that your investments are strategically placed for optimal growth.

Diversified Portfolio

By distributing investments across various asset classes and sectors PMS helps reduce risk while aiming for better overall returns, making your portfolio more resilient to market fluctuations.

Active Monitoring

With continuous oversight and proactive management your portfolio is regularly reviewed and adjusted to keep it on track, capitalizing on market opportunities and minimizing potential risks.

Transparent Reporting

Stay informed with detailed easy-to-understand reports that offer a clear view of your portfolio’s performance, updates and any strategic changes made providing full transparency.

Wealth Creation

Designed for high-net-worth individuals, PMS focuses on building wealth over time with strategies that focus on sustained growth and maximizing returns for the future.

Tax Guide for Investors

Holding Periods

- Listed Securities: Long-term if held >12 months.

- Unlisted Securities & Other Assets: Long-term if held >24 months.

Tax Rates of Short-Term Capital Gains (STCG)

- Listed Securities: 20% (previously 15%).

- Unlisted Securities: Taxed as per the income tax slab rates.

Tax Rates of Long-Term Capital Gains (LTCG)

- Listed Securities: 12.5% (previously 10%).

- Unlisted Securities: 12.5% (previously 20%).

Exemption Limit

- LTCG on Listed Securities: Exemption limit increased to ₹1.25 lakh per annum (from ₹1 lakh).

Dividend Income

Taxable at slab rates. (TDS can be deducted at prescribe rate)

PMS Partners